Your 5 per thousand to tell about climate change

Through education and culture on climate change, people will autonomously change their habits reducing their environmental impact, but it is necessary to make them passionate about the subject.

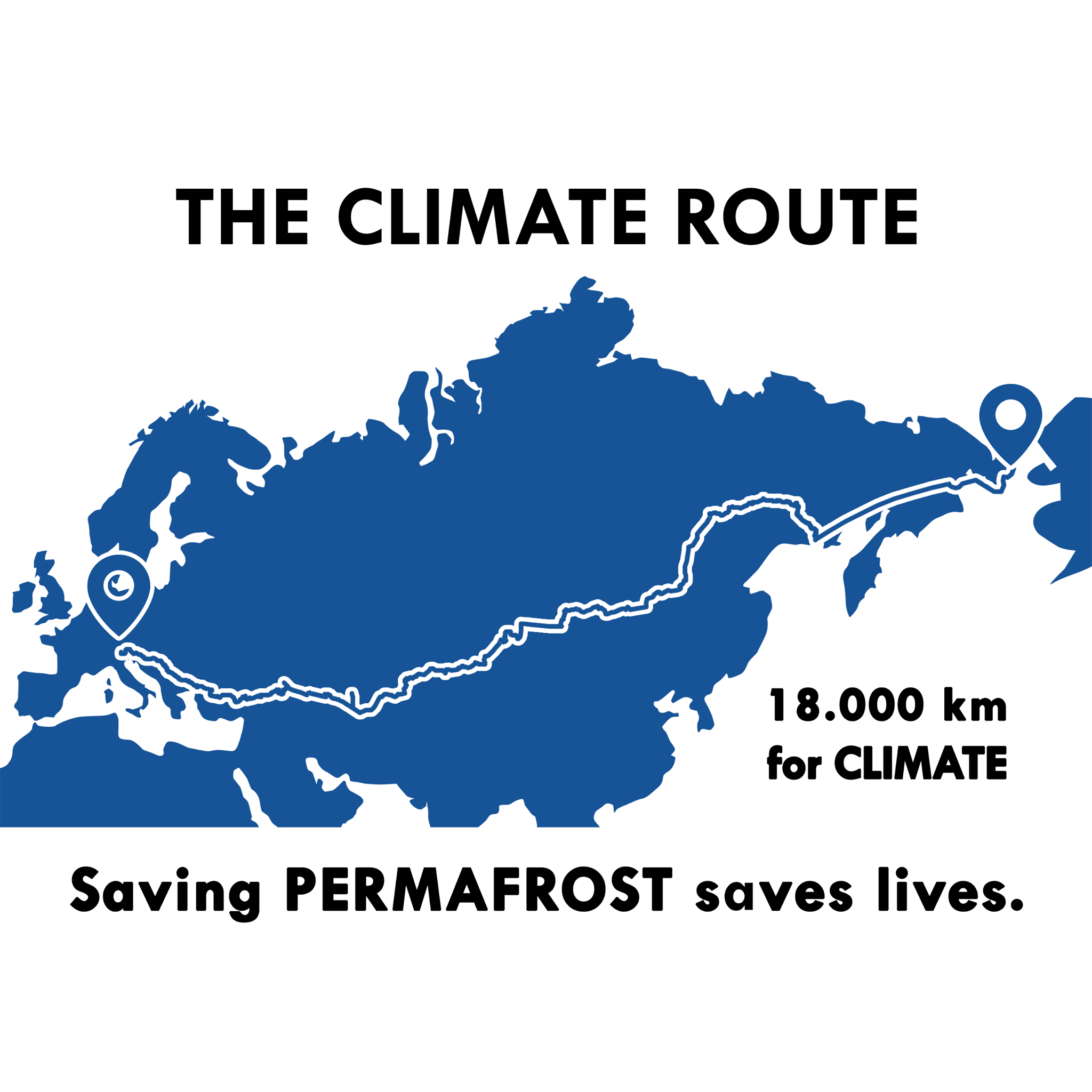

Support with your 5 per thousand the expedition from the Marmolada to the Bering Strait to tell all the effects of climate change on the populations we will meet.

fiscal code

91178290408

put your SIGNATURE on it

How can you give 5 per thousand to tell about climate change?

WHERE

1 – In the 730, Unico or CU form, find the space dedicated to the “Choice for the destination of 5 per thousand of income tax”.

SIGNATURE

2. Sign in the box “Support for voluntary work and non-profit organizations of social utility …”

WRITE

3- Enter the tax code

91178290408

under the signature

DONE

4. You have just CHOSEN how part of YOUR taxes will be used: to set course for a sustainable future!

How much is your 5 × 1000 worth?

What could we do together thanks to YOUR CHOICE?

The calculations are indicative. Check the amount of 5 per thousand with your accountant, but it is conceivable that with a monthly net salary of:

Your 5 per thousand is worth around € 22

with which you will support 2 km of the expedition

Your 5 per thousand is worth about € 33

with which you will support 3 km of the expedition

Your 5 per thousand is worth around € 78

with which you will support 8 km of the expedition

The answers to the questions we all ask ourselves about 5 per thousand

What is 5x1000?

It is a percentage of taxes (IRPEF) determined on the basis of income. Through the tax return it is possible to CHOOSE to whom to donate this amount of taxes among the subjects admitted in the 5 × 1000 lists

I do not present the declaration, can I still allocate the 5x1000?

SURELY! Even those who are not required to submit a tax return can choose to donate the 5 × 1000 to The Climate Route APS.

Just fill in the form with the choice of 5 × 1000 contained in the CU (Single Certification) and hand it in at the counter of a post office or CAF.

The form must be presented in a sealed envelope with the words “Choice for the destination of the eight, five and two per thousand of IRPEF”, together with surname, first name and your tax code. The service is free..

If I donate the 5x1000, can I also donate the 8 and 2 x1000?

Yes, because the 5 × 1000 does not replace the 8 × 1000 or 2 × 1000 mechanism. The 8 × 1000 offers support to the state or to religious denominations. The 2 × 1000 to political parties and cultural associations. While the 5 × 1000 is intended for certain purposes of social interest.

What are the deadlines for submitting the tax return?

The deadline for the delivery of the 730 (for employees and retirees) is 09/30/2021 for both the pre-filled and the ordinary.

The deadline for the delivery of the Individual Income Model (formerly Unico) is:

30/06/2021 for those who can present the Income Model still in paper form at post offices

11/30/2021 if the Income Model is transmitted electronically.

The deadline for the delivery of the envelope containing a choice of 5 per thousand of the CU (Single Certification) at post offices is 30/11/20210.

But if I don't give the 5x1000, does it stay in my pocket?

NO. It has no cost and is not an additional expense. The 5 × 1000 is a fraction of the personal income tax (personal income tax) to which the State waives. If you decide not to allocate the 5 × 1000 to anyone, this fee will still be paid to the State.

What happens if I only sign without indicating the tax code?

If the tax code is not specified, the amount will not be attributed to The Cliamate Route, but will be divided in proportion to the number of preferences received by associations belonging to the same category.

Send a reminder

Write your address and you will receive an email with our tax code.

Proceeding with the submission, The Climate Route will use the personal data entered in the form for the sole purpose of sending the reminder with the tax code.

Furthermore, by clicking on the “I wish to receive the newsletter” you authorize The Climate Route to keep you updated by sending information material or the periodic newsletter. By clicking on the “I do not wish to receive” you will receive the reminder by email, but you will not receive updates.